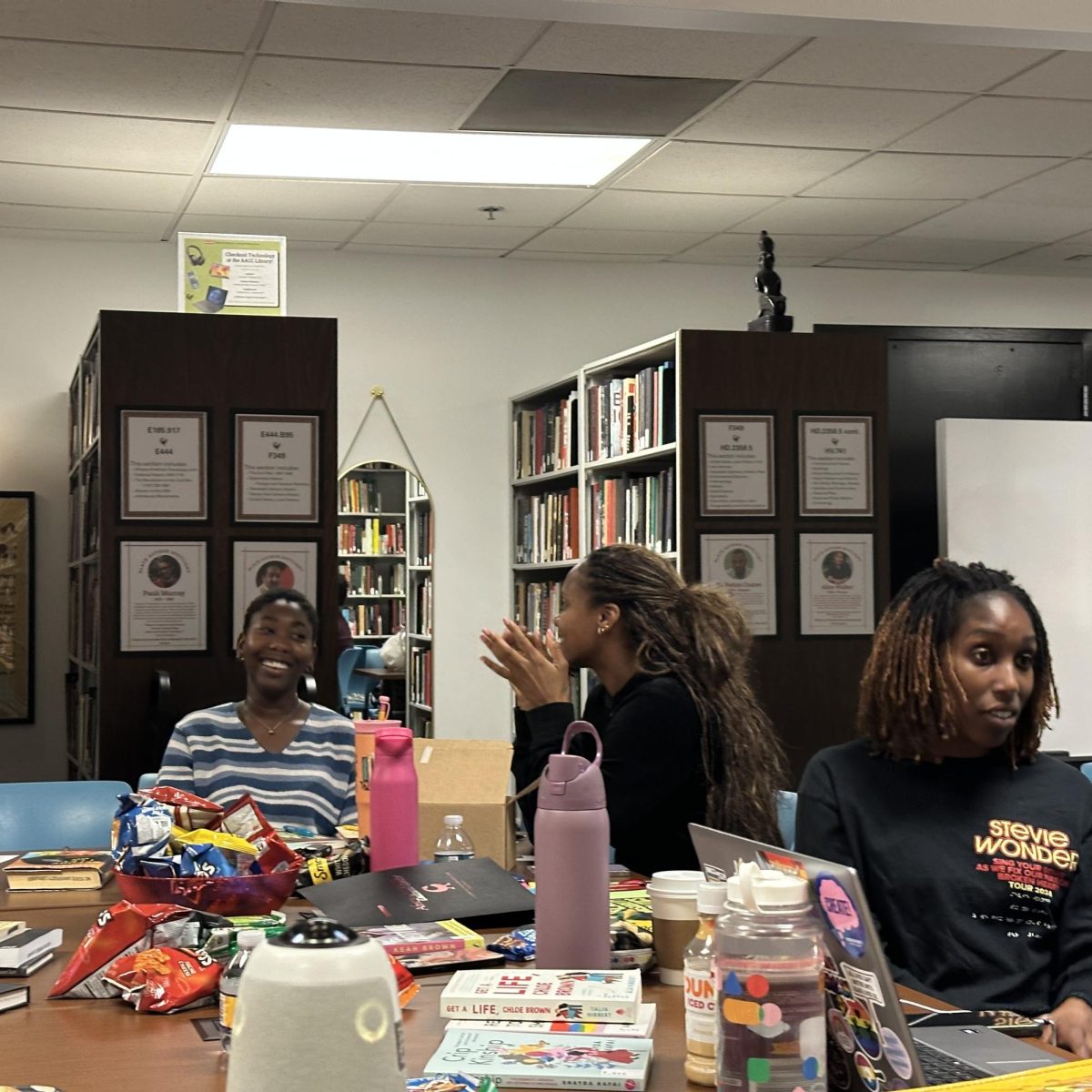

On Oct. 26 2021, the Mu Omicron chapter of Delta Sigma Theta Sorority Inc. hosted Making the MOst of Your MOney, an event to teach attendees how to budget efficiently and effectively.

Before the guest speaker gave their presentation, attendees’ background knowledge was tested via Kahoot. Attendees also received some general information on budgeting in college.

Some of this information included the benefits of budgeting. The four ones given were that it allows for full control over one’s own money, it helps set and focus on financial goals, preparation for unexpected costs, and it allows for awareness over savings and debts.

After giving the base information, the main presentation was done by guest speaker Lori Jones Gibbs. Gibbs is a member of Delta Sigma Theta Sorority, Inc. and Senior Vice President, Community Development Carolina Market Manager for PNC. Gibbs is a member of multiple boards such as, National Institute for Minority Economic Development and North Carolina Community Actions Association. She has also written and published a couple of books.

Gibbs’ started her presentation by saying the goal is to be smart, sophisticated, financially savvy women and said “there is nothing more dangerous than an educated Black woman”.

The actual financial aspects of Gibbs presentation started with budgeting. A budget is described as an estimate, a summary of income and expenses for a period of time, a written spending plan, and tool to organize finances. The simplest way to describe a budget however is income minus expenses.

Gibbs also mentioned other ways of why budgeting is important; it helps build assets and improve quality of life and shows responsibility.

The suggested budget approach given in the presentation was the 10-10-20-50 rule. In this approach 10% of your income goes to donations, 10% for personal savings, 30% for cash which is for wants and fun (i.e going to see a movie), 50% goes to your total monthly debt or essentials which would include things such as rent.

Delving further into expenses, another piece of advice was to manage your needs versus wants. Some examples of this were needing a purse versus wanting a luxury purse and needing a car but wanting a brand new car. However, wants should not be completely ignored. It is important to include wants into your budget because according to Gibbs “a budget that does not include wants is doomed to fail.” The audience was also told that there is no shame in not wearing designer clothing or re-wearing clothes.

There was also a general tutorial on how to start your own personalized written budget. The two steps are to determine your income and then determine your expenses. Income includes things such as wages, bonuses, recurring gifts, and interest. To determine expenses, track spending habits, writing down everything that is bought, and how much those items prep cost.

The budget section ended with listing off some apps that would make budgeting easier to do. Acorns is an app that invests your change from purchases and allows you to slowly save over time. Mint is an app for monthly budgeting. Albert is an app that analyzes your transaction history over time which helps figure out your income. This app is especially handy if your income is not steady. YNAB (You Need A Budget) is for people who share their spending with their partners. Wally is an app that helps the user understand their spending and it creates the budget for them. Some other apps mentioned were PocketGuard, Prism, and Clarity money.

The next part of the presentation was about savings. This section started off with some general saving tips. Some of these tips were to direct deposit to savings instead of checkings, save extra money from birthdays, holidays and cash gifts and apply at least 50% of pay raise to savings. A more old school tip is to put excess change in a jar or container at the end of each day.

A more specific saving plan that Gibbs gave during the presentation was the 52 week savings plan. In this plan the weak number correlates with how much money is put into a savings account. For example in week one you put one dollar in your account and so on. The plan can also be reversed, with week one meaning to put $52 into an account and then decreasing the amount of money put in each week.

Again to relate to the audience of college students, Gibbs included some money saving apps. Qapital is the best for goal setting, it rounds change to the nearest dollar and moves into savings, and it allows for specific goals to be set and named. Digit is a simpler app that calculates what its user can save and sets it aside and includes a savings bonus every three months. The previously mentioned app Acorns can also be used for saving.

Considering the audience was young women, the presentation also included a special notice to women. If you are married, divorced, separated or widowed make sure that all relevant credit information is filed under your own name. In the present day having control of one’s finances is the norm for many, however there was a time when men would handle all finances. The reminder is just to make sure that women are able to be financially free.

Gibbs’ presentation concluded with a question and answer section where the audience could ask for clarification or for advice on finances. One of these questions had to deal with credit, which Gibbs replied with a proposition to come back and get a presentation on credit.

After the question and answer section, the event moved into the discussion section, where the audience was prompted with questions. Some of these questions were “how can we make financial education more accessible?” and “what are some things you struggle with in terms of financial education?”. The discussion allowed for people to share their own personal experiences as well as show the knowledge learned from the event.

Making the MOst of Your MOney was an event that allowed college students to learn how to handle their finances and gave them the resources to do so.